Taxation generates revenue for the government, which in turn converts that income into projects and programs for the benefit and welfare of its constituents. The discussion on taxation in the United States is not for everyone because it can be quite complex. Still, no one can unlawfully escape their responsibility as a taxpayer and an upstanding citizen without paying for the consequences! Whether moving to different states or making purchases in another state, we must consider the tax we will be paying.

In this article, we will be focusing on the most transparent type of tax: the Sales Tax. It is the tax imposed upon the seller, who then passes the burden to the buyer, for the former’s privilege of offering tangible personal property (TPP) for sale at retail. This type of tax yields the most revenue for the government at the point of purchase. It is the tax that appears on the receipt of every purchase you make or service you avail, from food, groceries, medicines, clothing, footwear, automobile, textbooks, tobacco, alcohol, motor fuels, and services. It is computed by multiplying a flat rate by the total purchase price.

Sales tax, however, varies by jurisdiction from state to state, and other cities, towns, or counties also collect sales tax on top of the already state-wide rate applied. Many states have relied heavily on this regressive tax, meaning the tax burden across economic classes is disproportionate. The low-income earners are made to pay out a larger portion of their salary compared to the high-income earners who can barely feel the burden of the sales tax on their income since both classes pay the same percentage for their purchase.

There are exceptions to the rule. There are persons and institutions, mostly charitable, religious, and educational organizations, excused from paying sales tax under given circumstances. There are products and services exempted from sales tax or are taxed at a lower rate. Some States have 0% sales tax or offers tax credits to constituents.

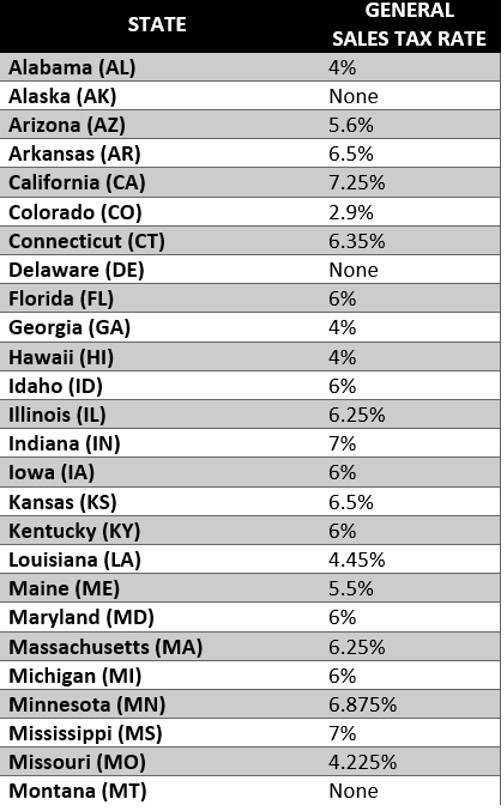

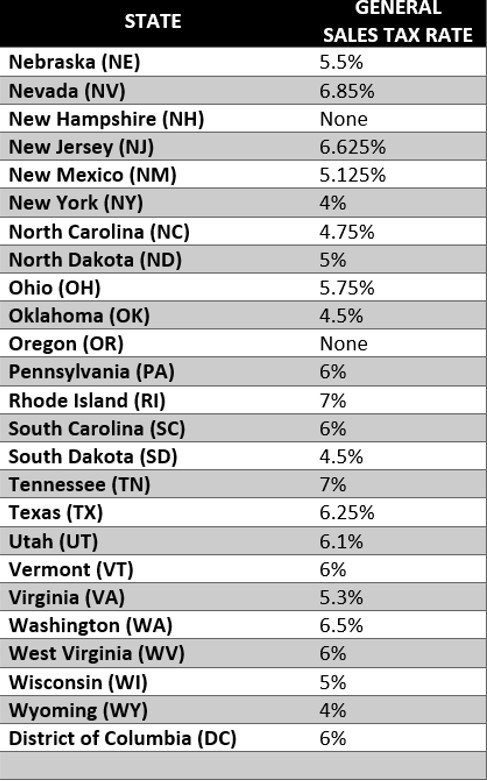

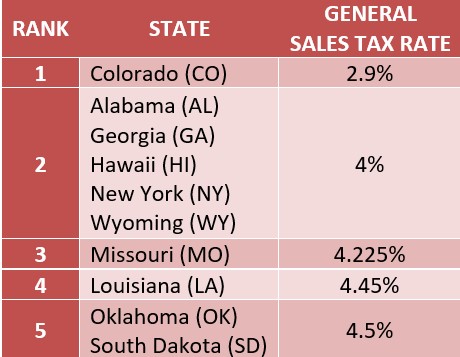

The Federation of Tax Administrators has issued a list of State Sales Tax Rates as of January 1, 2020:

It is worth noting that five (5) states do not charge any sales tax in their jurisdiction. These are Alaska, Delaware, Montana, New Hampshire, and Oregon. It is because of this fact that Delaware has been dubbed as the Home of Tax-Free Shopping. Despite the absence of state-imposed sales tax, local cities, municipalities, and counties charge local sales tax on the products purchased from their localities in addition to federal taxes.

Under the general sales tax category, the states with the lowest rates are as follows:

Aside from the low sales tax rate, one should also take note of sales tax holidays. It is when several states exempt specific product types from sales tax at a maximum cost or limit exceeding which, regular rates apply. These sales tax holidays could last up to 2-7 days at a time, depending on the approved legislation authorizing such. Products that are usually exempted during sales tax holidays are clothing, school supplies, computers, energy star products, disaster preparedness generators, air conditioners, footwear, books, firearms, ammunition, hunting as well as other supplies and preparedness items. Just this year, Tennessee has started sales tax holidays on restaurants.

Aside from state-wide sales taxes, thirty-eight states also charge consumers with local sales taxes on top of the former resulting in a higher overall sales tax despite a low state-level sales tax. Locally-imposed sales taxes range from 0.5% to 8%, with Hawaii having the lowest rate and Colorado having the highest. When the average of both the state and local sales tax rates are computed, Tennessee, Louisiana, Arkansas, Washington, and Alabama garnered the top five spots for the highest average. Their averages range from 9.22% to 9.53%.

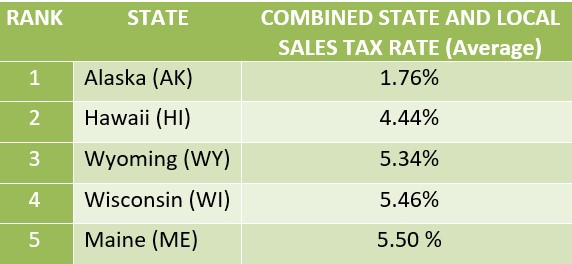

On the low-averaging side in the category of combined state and local rates, we have the following states:

One can easily mistakenly equate high sales tax rates with high revenue, but because consumers are never out of options today, they don’t feel stuck with purchasing within their state. The differences in sales tax and relatively lower rates, especially in neighboring states, makes people decide to buy online instead regardless of the additional shipping fee because the final price is still lower compared to when they buy within their state. Others opt to personally shop in another state or locality regardless of the time and travel required. This movement amongst consumers is the reason why high rates don’t always usually yield high revenues for a state. Sometimes the state is left with low purchase activity instead.

Food and Groceries

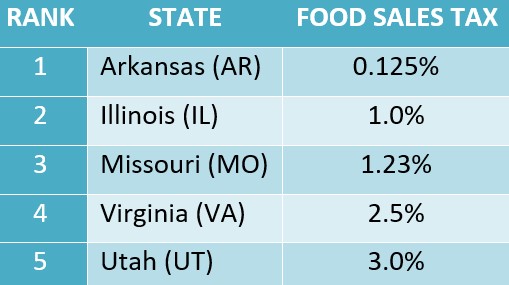

Since food is a basic necessity which some can barely afford, most states forego charging sales tax on it except Alabama, Arkansas, Illinois, Mississippi, Missouri, Utah, Virginia. In contrast, local taxes are imposed in Georgia, Louisiana, North Carolina, and Tennessee. The sales tax charged on food in these states ranges from 0.125% to 7%.

There are also those states that charge sales tax on food but, at the same time, provide rebates or tax credits, especially for low-income households, to alleviate the burden of this specific tax. These states are Hawaii, Idaho, Kansas, Oklahoma, and South Dakota.

Among the states still imposing sales tax on food and groceries, the following have the lowest rates:

However, some food products are excluded from the list of some states which do not impose a food sales tax. It also varies from state to state, but most of these products which are excluded from the exemption are soda, candy, confectionery, chewing gum, chips, ice cream, yogurt, dietary supplements, prepared foods, bottled water and many more. Determining which products are taxable or which are excluded from the exemption can get tricky because they differ with every state.

Drug or Medicine

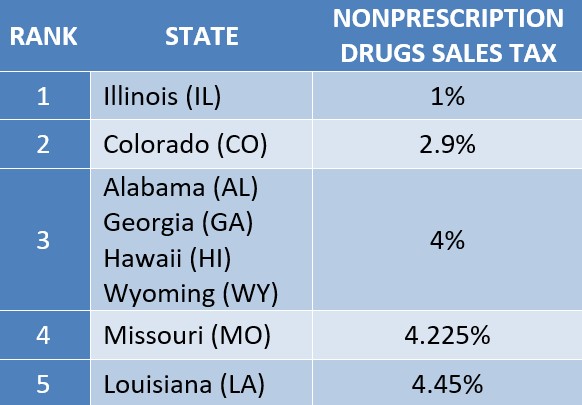

The tax identification for drugs or medicines is divided into prescription and nonprescription or over-the-counter drugs. Prescription drugs are sales tax-exempt in all states, except in Illinois, where it is charged a sales tax rate of 1%. As for nonprescription drugs, they are generally subject to each state’s general sales tax rate, like for Illinois, which charges still a 1% sales tax. States that likewise extended the exemption from sales tax of nonprescription drugs are Florida, Maryland, Minnesota, New Jersey, New York, Pennsylvania, Texas, Vermont, Virginia, and District of Columbia.

As for Illinois and the other remaining states that still tax nonprescription or over-the-counter medicines based on their general sales tax rate, the following are those that charged the lowest sales tax:

Clothing and Footwear

The fashion industry is one of the biggest industries in the country, and people are of the impression that clothing is always taxable across all states. Aside from the four states, such as DE, MT, NH, and OR that do not charge general sales tax for clothing and footwear, and except Alaska, where local sales taxes apply, other states may also not charge sales tax on specific clothing and footwear items.

In Massachusetts and Rhode Island, a cap of $175 and $250 respectively are set as exempt from tax, and any amount exceeding said cap shall be subjected to sales tax. In New York, items priced above $110 are considered taxable. In these three states, as well as in Minnesota, New Jersey, Pennsylvania, and Vermont, most clothing and footwear items are exempt from sales tax.

This type of tax, however, may apply to specific items such as clothing accessories, handbags, fur clothing, jewelry, formal apparel, belt buckles, costume masks, athletic and protective clothing, and shoes. Furthermore, a luxury tax is also imposed in the state of Connecticut at a rate of 7.75% for items, such as watches, handbags, wallets, and luggage, with price tags exceeding $1,000.

While a majority of states still impose sales tax on clothing and footwear, there are those that tax at minimum rates or based on their general sales tax rate. The ranking of states that impose the lowest sales tax on clothing is similar, as shown in the table in the category of general sales tax except that New York is not included in the list anymore.

Automobile

How much you need to spend on your car purchase is the sum of the different fees for the registration, the dealership, and of course, the taxes you need to pay. Because sales taxes vary from state to state, the car prices also depend on which state you reside.

In some cases, it also depends where you buy your car because of the concept of reciprocal tax relationships between other states, which means that the sales tax paid by a non-resident to a certain state is credited in favor of that purchaser’s state of residence. It is best to check first with your state’s Department of Motor Vehicles (DMV) the corresponding tax liability and existing tax relationships with other states if you are planning to purchase outside your state of residence.

The sales tax rate for cars is much higher compared to the general sales tax imposed by each state. Out of the five states previously mentioned that do not charge general sales tax on the state level, Alaska charges a rate of 7.5% sales taxes exclusively for a car purchase. Oklahoma charges the highest car sales tax at 11.50%, together with ten other states that charge more than a 10% rate for your car purchases.

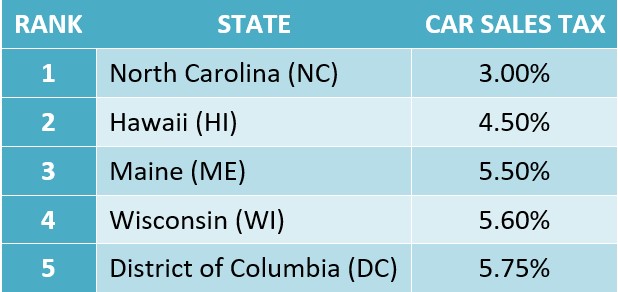

If you are a resident of any these states, you are required to pay the lowest car sales tax in the country:

There have been confusions about where you will pay the sales tax if you purchased your car outside your state of residence. Most of the time, it is the dealer who is responsible for collecting the sales tax from you and remitting it to the taxing authority responsible in your state of residence. One cannot escape paying sales tax since the Department of Motor Vehicles in your state checks thoroughly before registering your car. There are instances when you will have to pay the difference of your state’s car sales tax from the sales tax you already paid in the state where you bought your car if the sales tax is higher in the latter.

If you are from Oregon where the no-sales-tax policy applies and you decide to buy a car from a different state, remind the dealer to fill out forms specifically for Oregon residents so that the “no sales tax” car purchase would apply to you.

Textbooks

Textbooks can be considered as part of the big items as exempting it from sales tax can help a lot of students through college by lessening the burden for the four years or more they are in university. The sum of all sales tax on the textbooks they bought can be considered huge savings on their part and could be well spent on other necessities for school. Generally, textbooks are subject to sales tax at the general rate imposed by the state.

However, the majority of states in the country exempt textbooks from sales tax under special and specific circumstances. Aside from the five sales tax-free states (AK, DE, MT, NH, and OR), these states also impose the no-sales tax policy on textbooks subject to several requirements:

These states consider these factors for exemption: (1) if the textbook bought is required for a course especially in non-profit institutions, (2) if it is required by the university, college, or private occupational school, (3) when it is sold by the educational institution itself to its student, (4) when the bookstore selling it is located within the university grounds or its officially designated bookstore, and (5) when it is a used textbook.

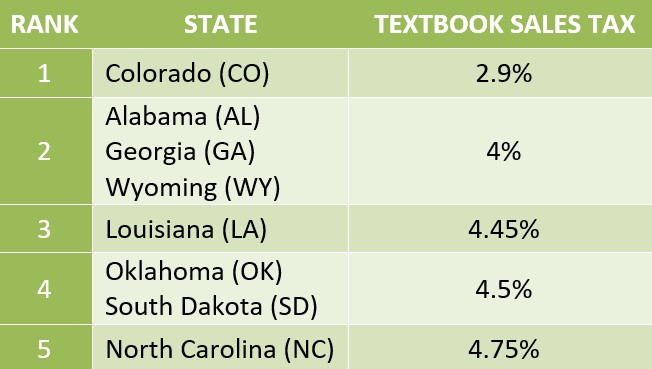

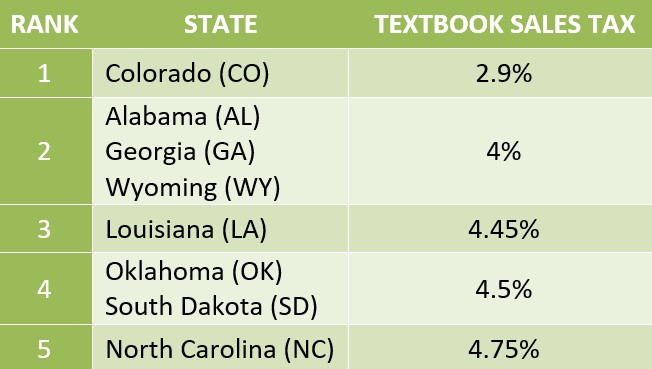

For those states that still impose sales tax on textbooks, these are among the lowest rates:

Services

Services like barbershops, parlors, dry cleaning, and carpentry are also taxed. The list goes on for services charged for sales tax, but professional services, such as that of doctors and lawyers, are seldom taxed and by only a few states. New Mexico and Hawaii are among those states that tax almost all services. The imposition of sales tax on services gets complicated when products are also purchased simultaneously and in connection with the service. Again, it all depends on the law of the state that imposes the tax.

Selective Sales Taxes

Selective sales taxes are taxes imposed by the state on specific products, usually with rates higher than the general sales tax. Sin tax imposed on tobacco and alcohol is an example of a selective sales tax, the purpose of which is to increase the purchase price so that consumers would be discouraged from buying and eventually from consuming them.

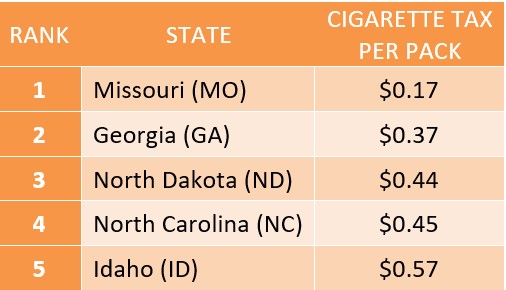

Tobacco. This includes cigarettes, cigars, loose tobacco, e-cigarettes, and other vaping products. All states impose this type of tax on the mentioned products but at varying rates. The cigarette tax is computed per pack. Some states impose additional local taxes and fees on top of the state-level cigarette tax. As of 2020, the District of Columbia ranks the highest when it comes to cigarette tax at $4.50 per pack. The states with the lowest state-imposed cigarette tax are:

Alcohol. Aside from the general sales tax, local sales tax, and special sales tax imposed on alcoholic beverages, they are also taxed at different levels and in different ways across states. There are states that tax at the wholesale level resulting in a higher retail price after the same is added. Varying tax rates per gallon, in the form of excise tax, are also imposed upon different types of alcoholic beverages like wines, beers, and other distilled spirits.

These states (excluding those that do not impose them or where it is the government that exclusively sells alcoholic beverages) are ranked based on each type of alcoholic beverages for excise tax:

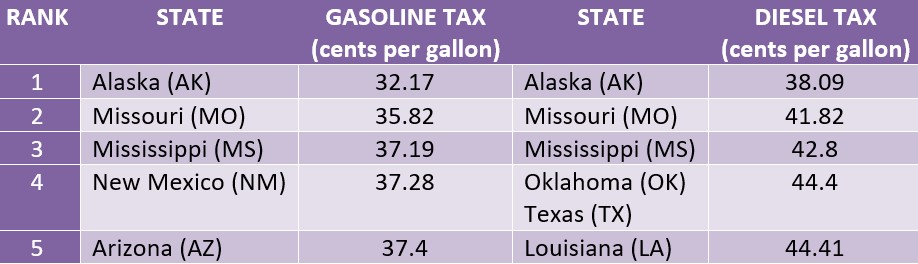

Motor Fuel. The tax on motor fuels is imposed by the gallon and not on the price you pay when you gas up. That means that the tax levied from you depends on the amount of fuel you purchase and not by how much you pay for them. Alaska has the lowest gasoline tax rate at 8.95 cents per gallon compared to Pennsylvania at the rate of 57.6 cents per gallon (CPG), the latter having the highest gasoline tax rate in the country. However, there are still several states that collect a percentage from the purchase price on top of the (CPG). The states with the cheapest motor fuels mainly because of low combined federal, excise, and other state taxes are as follows:

Internet Sales Tax

The law on Internet sales tax evolves through time. Almost all states are currently charging sales tax on internet and e-commerce transactions but only to a limited level depending on the number of transactions and profit involved. This change was made into a law by the U.S. Supreme Court Decision on South Dakota v. Wayfair in 2018, which foregoes the physical presence of a business as an element before the state can impose a sales tax.

If you need more information or clarification on specific topics related to taxation, you can check this list of government sites by state and contact your respective state taxing agencies.