As adults, we know that among the many things that we should not talk about in parties – money lands on the top of the list. Money is not a typical cocktail party conversation starter. It is such a taboo subject that many of us shy away from. Even talking about it with the people we are closest to can be awkward. Why? Because we are discouraged to talk about our finances in the first place. This may be because money represents so much more than just a piece of paper. Money is an integral part of our life. Aside from that, it serves a profound symbolic meaning. It is a status symbol that all of us aspire to possess.

Watch: Why It's Hard to Talk About Money With Your Honey

If your finances bring you more stress and anxiety than relief, we think it best that you reexamine your decisions. The next time you find yourself at a party, you do not need to feel embarrassed or ashamed of whatever you have. Ignoring your financial situation will do you more harm than good. It is important that you realign your priorities and invest in your future and opening a bank account is one of the best ways of getting started. Among the many advantages of keeping your money in the bank is gaining interest. Join the 93% of American households who maintain a bank account. There are a few kinds of accounts you can choose from –checking, money market, certificate of deposits or CD, retirement, and savings.

Different Account Types

A Checking Account is a basic bank account where you can deposit checks, as well as make withdrawals. Some use their checking account to pay bills, their employees, and other obligations. Checks, nowadays, are slowly losing their appeal, but it is the main feature of this type of bank account. The Money Market Account, on the other hand, is a unique kind that combines the key features of a checking and savings account. It also earns a considerable interest over time, but not as much as the Certificate of Deposit or CD account. This option is best for long-term savings, but not ideal if you depend on your money for everything and anything. You need to commit to keeping your account balance for a certain amount of time, a lock-in period within which you withdraw from the account.

If you are the kind of person who wants to relax after years of hard work, we recommend that you open an Individual Retirement Account (IRA). As soon as you get a stable job is the best time to get one. One of the key features of this kind of account is the tax advantage. The interest your money earns is exempt from taxes. Most banks offer IRAs and you get to choose between the traditional IRA and Roth IRA.

Watch: The 5 Daily 2-Minute Tasks That Made Me Good With Money

Of course, starting small is an ideal first step towards financial stability. This way, you do not get intimated by complexities that personal finances bring. You do not have to learn everything about savings and money all at once. Through this article, we aim to give you a jumpstart in your journey towards financial success. We will highlight the ins and outs of Savings Account, specifically an online savings account.

What is a Savings Account?

Since 1816, savings account have been offered in the United State when American savings banks started operation in Boston and Philadelphia. The Provident Institution for Savings in Boston was the first-ever chartered savings bank in the country along with Philadelphia Savings Fund Society (PSFS). Following these two institutions, various banks and credit unions started offering the same services.

Simply put, a savings account is a safe place to keep your money while earning a small annual interest. It is an interest-bearing deposit account secured by a bank or other financial institutions. Aside from the minimal interest rate, it is the security feature that attracts many clients. Savings accounts are not only secure, but they are also reliable. It is ideal for building a personal emergency fund or keeping savings for short-term needs. Typically, saving accounts are the first bank account that anyone can open. Among the various kinds of bank accounts, it is the most straightforward option. In fact, in a 2019 survey by the U.S. News, approximately half of the respondents choose to open a savings account to keep their money.

Savings, along with other deposit accounts, are among the primary source of funds that financial institutions depend on. Your money moves in and out of your account. Basically, you move money in by depositing in your account, and out when you make a withdrawal. By depositing your money, banks have the resources to provide loans to other clients. Virtually every bank or credit union offer saving accounts. Whether you take care of your banking needs through the traditional brick and mortar financial institutions, or through online banks, a savings account is always a great choice.

Things to Consider

Once you have decided to open a savings account, there are three common ways for you to do so. You can either open an account in person, through phone or online.

How to Open a Savings Account

In-Person Opening a bank account in person is the most traditional way, and with today’s fast-paced environment, the least preferred option. However, there are a handful of people who prefer going to their bank or credit union branch. This way, they can inquire about the various features, as well as the terms and conditions attached to every transaction. To get started, you need to bring enough money, either cash, check or debit. You must reach the minimum opening balance requirement for new accounts. We deem it best that you check your bank’s requirements prior to your appointment. Aside from your opening deposit, you should bring at least two valid identification such as your driver’s license, passport, or a company ID. Most importantly, have your Social Security number memorized or readily accessible. The bank teller will need this information for verification.

By Phone With our hectic schedule, it is understood that we want to skip long lines at the bank. Phoning in with your application is a faster process in comparison to in-person transaction. One advantage to applying by phone is you get to speak with a customer representative. So, you also get the chance to ask questions when the need arises. You will get real-time answers from bank representatives.

Online Today, most banks offer online applications as well as fully online transactions. This is not only convenient, but also easiest way of opening a savings account. In a busy world, having your banking needs satisfied is priceless. You do not need to make several trips to the bank. With digital forms and e-signature, you can open a savings account with just a few taps on your mobile phone or computer. When opening a bank online, you need to prepare your personal information. By providing pertinent information, the bank can verify your identity. An initial deposit is also required, so deposit or arrange to wire money to your new account.

You must be aware that even though you are bringing new business to the bank, it has the discretion of rejecting your application. This might be because of unpaid fees, bad credit record, you have overdrafts on other accounts, and fraud allegations or conviction. Another reason is insufficient identification. It is important that you are prepared with all the requirements.

Opening or Initial Deposit

Most banks require a minimum opening deposit. They typically require $25 to $100 as an initial deposit. When you open an account in-person, you can deposit cash, check or debit, but when you do it online or via phone, you will need a debit card. You can wire the required amount from one account to the new one. All things considered, the amount is not an onerous imposition on clients. After all, the main point of opening a savings account is to deposit money. Plus, you get to enjoy the services that come with having a savings account.

If you want more freedom or if you have limited funds, there are a few banks with an even lower initial deposit. But if you are looking for a bank that does not require a deposit upon application, you may stumble upon a few. Banks that operate entirely online or online-only banks do not necessarily require an initial deposit.

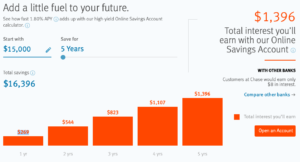

Interest Rate

Arguably the single most important feature of a savings account is its interest rate. However, this type of bank account often offers the lowest interest rate in the market. The average annual percentage yield (APY) across all savings accounts in the country is just 0.08 percent. APY represents the bank’s assured annual rate of return. This is according to the Federal Deposit Insurance Corp. But some banks offer frustratingly low APY as low as only 0.01 percent. If you are looking for a place to grow your money, this is not the best choice.

However, the argument remains that savings accounts are not meant for earning from your savings. There are higher interest rates, of course. For instance, the Northfield Bank’s platinum savings account offers a 2.25 percent APY. The downside, however, is the high maintaining balance. So you have to weigh the pros and cons that come with having a savings account. It is important to note that a 2 percent APY is a healthy interest rate for a savings account – the best option for most of us.

Watch: How Interest Rates Are Set: The Fed's New Tools Explained

Minimum Maintaining Balance

Banks impose a minimum cash deposit on almost all bank accounts. This is a feature that ensures clients are actively maintaining their savings account. Some premium account require at least $2,500.00 on deposit. If you go below the maintaining balance, your bank will hit you with a penalty. It is important that you check the terms and conditions that come with your savings account. This will not only help you save more, it will also give you the peace of mind that your money is safe.

Monthly Fees

Lucky for you, banks offer a waivable monthly fees for new clients. But the Federal Reserve, and Regulation or the “Reg D” has implemented mandatory fees. For example, when you go beyond the six transaction limit, you might be charged as much as $15. Your bank will charge you the fee for every instance you make a withdrawal or deposit. On top of this, there are financial institutions that charge monthly maintenance fee. This is most common on accounts that do not meet the minimum balance requirement. Of course, it is best if you avoid these unnecessary charges. Learn more about the imposed fees and dues so you can have more control over your account.

Withdrawal Limit

Because banks are under strict regulation by the Reg D, account holders are limited to six monthly transactions. This includes both transfers and withdrawals from your savings accounts. The Reg D regulates common transactions, including automatic transfers, debit card payments, bill payments, which are recurring transfers. This is to protect account holders from fraud, theft, and illegal phishing activities. But this limit does not apply to withdrawals made or even money transfers completed at Automated Teller Machines (ATMs). More so, in-person withdrawal is not affected by this regulation. A 2019 survey revealed that less than 20 percent of savings account holders make a withdrawal from their account once or more every month. The majority of the respondents said that they never took out the money from their savings account.

Access to Account

What if you get into an emergency in the middle of the night and you need cash? The first thing you want to do is access your savings account. You will be able to withdraw money in no time if your bank maintains a large network of ATMs. Let us say they do not, you will be left in a tricky situation with not enough money on hand. This used to happen to many bank account holders before but is no longer the scene today. What was once a rare feature is not integrated into our daily affairs – mobile or online banking.

Accessing your savings account is possible 24/7. You can deposit checks through mobile deposits. Simply enter the check number on the mobile banking app on your phone or computer to deposit a check. Some apps just ask that you take a picture of the check, both the front and back faces, and instruct your bank to make the deposit for you. It is highly convenient and efficient, arguably, even more, efficient than traditional banking. Moreover, ensure that your bank offers automatic transfers from your savings account. You can send money to your loved ones with just a few taps on the app. Most importantly, you can wire money to your own savings account from another account making saving for the future easier.

Access is only one of the many advantages of online banking, especially of an online savings account. In a nutshell, compared to a brick and mortar bank, online savings accounts offer higher rates, minimal to zero monthly fees, no minimum balance requirements, and cutting-edge technology. Online banking used to be only offered by online-only banks, but with steep competition, traditional banks now developed their online capabilities. A few also ventured into online-only options, emphasizing lower fees and high rates.

Online Savings Accounts

Self-service Feature This is a must for the busy tech-savvy millennial of today. For many of us who are always on the go, having the freedom to complete banking transactions is a must. Managing your account is easy, especially with user-friendly mobile banking app. You can do virtually everything in your mobile bank. If ever the need for a customer service representative arises, most banks offer 24/7 customer service. You can simply call the bank’s toll-free hotline for any pressing concern.

You can Link Several Accounts If you maintain several bank accounts under one bank, you can control and manage all of them in a single app. By linking your account, you can deposit to one account from another without the need to change your window. Make withdrawals and deposits from any of your accounts with the convenience of your mobile phone.

Go Cashless Online savings account allows you to pay bills online, use it as a debit card, or even write checks. Bank transfers can be completed in only a few minutes. You can leave the house without carrying an unreasonable amount of money, especially if it is time to pay the bills. Live with ease with an nline savings account and go cashless.

Paperless Loan Application Applying for a loan is a labor-intensive process and requires a ton of paperwork. With your online savings account, you can simply input your personal information, send it to your bank and wait 1-5 business days for a response. If the bank needs more information from you, they will reach out to you to complete the application. Some lending institutions operate entirely online, which makes the loan processing even faster.

Competitive Rates If you are mainly looking for good rates, online banks offer the most competitive rates in the market. You get to earn higher interest in online savings account, while paying less fees. Shop around and compare the rates of online banks so you can land a good deal.

Easy Deposit Snap a photo of your check and end it to your bank for easy, remote check deposit. This is an innovative feature that reduces the probability of having your check dishonored by the drawee bank. Most importantly, you do not need to visit your bank, or mail the check in.

Access to Account History With your mobile bank app on your phone, you can always check your account online. Check the current balance, if your check cleared, or if your payment was posted. Having access to your account at all times will keep you at ease, ensuring that your money is in good hands.

Insurance

Banks are persistent in introducing savings accounts as a secure place to keep your money with minimal threat of loss. So your bank of choice must be insured by the Federal Deposit Insurance Corporation (FDIC). This way, your money is safe even in case of bankruptcy or corruption. Your money in insured up to $250,000.

Methodology

Now that you know the basic considerations in choosing the best online savings account that meets both of your preferences and expectations, here is a list of the Top 5 Best Online Savings Account. This list consists of several banks that operate in the United Sates. The different banks are ranked based on the following features of their online savings account – Ease of Enrollment, Interest Rate (Annual Percentage Yield), Online Features, Account Maintenance, and Fees and Dues. These features are given a star rating between to . An overall rating will be provided for each brand the highest being .

The chart below highlights and makes comparison of the different banks we hand-picked for you. A detailed review will be provided to help you choose the first step towards financial independence.

Comparison Review Chart: Top 5 Best Online Savings Account

| Bank | Ally Bank | CIT Bank | TAB Bank | Capital One | Discover Bank |

| Opening Deposit | $0 minimum opening deposit | $100.00 minimum opening deposit | $0 minimum opening deposit | $0 minimum opening deposit | $0 minimum opening deposit |

| Account Enrollment | Online enrollment | Online enrollment | Online enrollment | Online enrollment | Online enrollment |

| Interest Rate | 1.70 percent | 1.80 percent | 2.10 percent | 1.80 percent | 1.80 percent |

| Minimum Balance | $0 minimum balance | $25,000.00 or $100 monthly deposit | $0 minimum balance; $1 daily balance | $0 minimum balance | $0 minimum balance |

| Monthly Fees and other Dues | No monthly fees; $25 overdraft; $10 excessive transaction fee | No monthly maintenance fees | No monthly service fees | No monthly service fees | No monthly service fees |

| eCheck Deposit Feature | Yes | Yes | Yes | Yes | Yes |

| Access to ATMs | No ATM access | No ATM access | No ATM access | No ATM access | No ATM access |

| Customer Support | 24/7 customer support; Call, chat or email anytime | 24/7 customer support | Available Mondays thru Fridays, as well as Saturdays; Except federal holidays | 24/7 customer support | 24/7 customer support |

| FDIC Compliance | Member FDIC | Member FDIC | Member FDIC | Member FDIC | Member FDIC |

| Headquarters | Sandy, Utah, United Sates | Pasadena, California, United Sates | Ogden, Utah, United Sates | McLean, Virginia, United Sates | |

| Remarkable Features | * No minimum opening deposit * Excellent customer service * No monthly maintenance fees and minimum balance requirement * Flexible and secure * FDIC-insured | * No monthly maintenance fees * Two ways of earning interest – APY tier * You can earn 1.833 percent interest upon opening an account * FDIC-insured | * No monthly maintenance fees * No minimum opening deposit * No balance caps * High yield APY * Streamlined application process * FDIC-insured | * High-yield savings account * Fee-free banking * No minimum balance required * No minimum opening balance * Access to ATMs * Mobile banking anytime, anywhere * Digital saving tools * FDIC-insured |

ALLY Bank

Watch:

Error! You must specify a valid width to use this shortcode!

Ally Financial Inc. or ALLY is one of the country’s leading digital financial services company. Its humble beginning can be traced back to 1919. What we know today as Ally began as GMAC, a division of General Motors which specifically caters to auto financing. In 2000, GMAC Bank was formed and later became Ally Bank in 2009. Ally Bank is Ally Financial Inc.’s direct banking subsidiary, offering an array of financial products and services, including an online savings account.

Ally Bank is committed and is a relentless ally for every client’s financial well-being. With over 8,000 teammates who tirelessly provide top-quality customer service and innovation, you can do more with your money. It delivers financial opportunities to anyone who needs it. Ally’s collective desire to serve the community, and to improve the financial capabilities of its customers, it remains a leader in online banking.

Key Features

Ally Bank is a fully operational online bank which directs its capital to its clients instead of investing in physical branches. You get the benefit of a competitive rate that generates consistent growth in your online savings account. And because interest is compounded daily, your money will also grow faster. Make your savings work harder for you. It prides itself with its 1.70 percent annual percentage yield which remains accurate as of today. This rate for an online savings account is over 15x higher than the reported national average by the FDIC Weekly National Rates and Rate Caps which is 0.09 percent APY.

You can start building your financial future at Ally Bank. With its $0 minimum opening deposit, anyone can own an online savings account. Plus, it does not impose monthly maintenance fees and other hidden fees. Free yourself with the burden of banking. Call, chat or email an ally in its 24/7 customer support with any concern. They are happy to answer any of your queries.

However, much like any other online banks, you cannot deposit cash in your online savings account. You can transfer money from one of your Ally Bank accounts or from another bank. Depositing check is made easier and more convenient with Ally eCheck DepositSM, a product of customer-centric innovation.

Watch:

Error! You must specify a valid width to use this shortcode!

Set-up bills payment with your mobile app whether one-time or recurring payments. As well as reduce clutter if you sign up with eBills. Ally is partnered with your favorite online stores. Make hassle-free payments to Apple Pay®, Google Pay™, Samsung Pay™ or Microsoft Wallet. And if you ever need cash, you can make a withdrawal, find nearby ATMs wherever you are.

Flexible and secure, the Ally Bank Online Savings Account values your trust. Your deposits are insured by the FDIC since Ally is a member of good standing. Online and mobile banking is guaranteed secure. Any unauthorized online or mobile banking transactions, if reported within 60 days, will not be charged to your account. On top of that, Ally Bank offers free security software. You can protect up to three devices with Webroot® SecureAnywhere™ software.

| PROS | CONS |

| $0 minimum opening deposit | Does not allow cash deposits |

| Flexible and secure online banking | |

| Reasonable APY | |

| Responsive customer support | |

| Free security software | |

| eCheck Deposit Feature |

Our Verdict

Ease of Enrollment

Interest Rate

Online Features

Account Maintenance

Customer Support

OVERALL

CIT Bank

A nationwide bank that predates our need to save, CIT Bank is a division of CIT Bank, N.A. founded in 1908. But the CIT Bank we know today was established in 2008 with the commitment to map out your future through banking. After a decade of existence, financing remains CIT’s top priority. Time and experience brought in remarkable innovations in how the bank conducts business. Grounded to its mission, it remains to be an agent of opportunity. Through various lending and deposit options, CIT is able to provide new resources and fresh perspectives to its clients and the community.

Accountability, collaboration, and customer focus are the main values that drive CIT Bank to be among the top 50 banks in the United States. It offers savings, money market products, and certificate deposits. Promising one of the highest APYs in the market today, CIT Bank is mapping a future of financial independence and self-sufficiency.

Key Features

Savings Builder is CIT’s online-only savings account that features a 1.85 percent APY. This is 0.15 percent higher than that offered by Ally Bank. It is among the country’s top rates – over 20x higher than the national average. Once you qualify during the first Evaluation Day, you can get a 1.833 percent interest rate from the moment you open your account. By building on this interest, your savings account can continue earning as much as 1.85 percent APY. There are two ways for you to do this or the APY tier. You can either keep a maintaining balance of $25,000.00 or above or make a monthly deposit of $100.00 or more. Interest is compounded daily as well, which maximizes your potential to earn more.

Watch:

Error! You must specify a valid width to use this shortcode!

Through this, online savings account, holders can build more savings and earn more. You can enroll by filling out an online enrollment form without the need to wire a minimum opening deposit. A monthly maintenance fee is something you do not have to worry about. Make subsequent deposits via funds transfer, mobile deposit incoming wire which is free of charge, or mail a check. Of course, the Reg D 6 monthly transaction limit applies to your CIT Bank online savings account, except as regards the frequency of deposits. Among the transactions mot subject to the Reg D limitation are automatic loan payments, transfers between CIT Bank accounts made by mail, withdrawals made through mail or telephone, and account transfers.

Like, Ally Bank, you can deposit checks remotely through the CIT Bank mobile app. One major downside to this account, though, is the lack of ATM access. Since it operates as an online-only savings account, you cannot withdraw cash from an ATM. If this is something you need from a bank, CIT Bank’s Saving Builder might not be the right choice for you. Regardless, your money will remain safe and sound since CIT Bank, N.A. is a member of FDIC. Your deposit is insured up to $25,000.00, and you will receive the same compensation for every account ownership category.

| PROS | CONS |

| $0 minimum opening deposit | Does not allow cash deposits |

| Flexibleand secure online banking | No access to ATMs |

| High APY | Withdrawal are done through mail or phone |

| Two ways of earning interest | Disbursement is made through check |

| No monthly maintenance fees | |

| eCheck Deposit Feature |

Our Verdict

Ease of Enrollment

Interest Rate

Online Features

Account Maintenance

Customer Support

OVERALL

TAB Bank

Watch:

Error! You must specify a valid width to use this shortcode!

TAB Bank opened its doors to the American public in 1998, promising to work relentlessly towards the American dream. From then, it helped people establish businesses, innovate market solutions, and capitalize on opportunities through responsible banking. TAB takes pride in being a part of its clients’ success. By cultivating strong relationships instead of focusing on transactions, TAB Bank is positive that financial growth is possible for everyone.

Whether you are just starting to invest in a savings account or applying for your first loan, TAB Bank is happy to serve you. With tech-savvy and forward-thinking partners, you can say goodbye to the stress that comes with your finances. You can rely on unique solutions, combining security and flexibility with every banking transaction. No matter how you choose to save your money, TAB Bank is one of the surest ways to go. Choose from its powerful options from checking, money market, certificate deposit, or high-yield savings accounts. Expect high returns, with every single account.

Key Features

For someone who puts primacy on interest or the annual percentage yield of savings account, TAB Bank is the ideal choice for you. The competitive 2.10 percent APY is not only attractive, but it is also very dependable. With TAB’s high-yield savings account, you can start maximizing your bank saving within minutes. TAB Bank has the highest APY on this list. You might wonder why we placed it as the third-best online savings account instead of first. It is because aside from the obvious high-yield APY, we consider other factors. In terms of customer service, ALLY maintains a 24/7 responsive customer support, while TAB’s hotline has a limited operation.

The smarter, simpler, and better intuitive banking system makes up for this. Once you decide to sign up, all you need is five minutes to complete your online enrollment. TAB’s software engineers and developers have worked on streamlining the application process, making the online interface user-friendly. Once you have successfully opened your online bank savings account, you will be greeted with an easy-to-use intelligent mobile app. The customer-oriented dashboard will make every online banking transaction quick and painless.

Watch:

Error! You must specify a valid width to use this shortcode!

Save with confidence with TAB Bank’s High Yield Savings with $0 minimum opening deposit needed. Both your money and personal information are safe with the end-to-end encryption in place. Online and mobile transactions are protected by the same top security measures. All you need to do is transfer funds, and watch your money grow based on the daily collected, compounded daily, and paid monthly balance. You can easily view your running balance via the online reporting tool. Monitor and track your activities and remain at ease. Sleep well at night without worrying about maintenance fees and other service fees. Plus, you know your money is safe because TAB Bank is insured by the FDIC. Relax.

| PROS | CONS |

| $0 minimum opening deposit | No access to ATMs |

| Flexible and secure online banking | Does not allow cash deposits |

| Competitive high-yields interest rate | |

| No balance caps | |

| Online and mobile banking access | |

| Optional eCheck Deposit Feature |

Our Verdict

Ease of Enrollment

Interest Rate

Online Features

Account Maintenance

Customer Support

OVERALL

Capital One

Watch:

Error! You must specify a valid width to use this shortcode!

Capital One continues its mission of changing banking for good. It provides genuine, simple, ingenious, and add humanity to banking. With the belief that technological innovation will change the banking industry altogether, it revolutionized how it does business. In 2012, Capital One finally acquired ING Direct. The acquisition placed ING Direct, one of the first online-only banks in the US, under Capital One’s control. It shortly became Capital One 360, Capital One’s online division operating fully online. Ultimately, Capital One 360 folded into Capital One. Today, the 360 brands are incorporated into their online banking products. The most popular service under the 360 brand is the 360 Performance Savings™.

The bold move towards an online-only banking has tremendously helped Capital One gain more success in the industry. It is now the country’s fifth-largest consumer bank. Moreover, it is the eight-largest bank overall, a remarkable feat for the bank. Since its first Initial Public Offering (IPO) in 1994, Capital One remains to be a pillar in both traditional and online banking.

Key Features

Capital One’s 360 Performance Savings™ is a high-yield online savings account, that anyone can open in about 5 minutes. This is in line with the company’s brand – Banking Reimagined®. With a high-yield savings account, you can earn up to 5x the national average saving rate. You will be getting more with every dollar you put into your Performance Savings account. Earn 1.80 percent APY on all your balances without worrying about any fees. Plus, you get to enjoy the free online tools that come with being a Capital One client. One of the free tools you get is the Automatic Savings Plan, as well as the top-rated mobile app. You can manage your money, whenever, wherever.

Capital One 360 Performance Savings offers great flexibility and incentives to encourage you to save. Upon approval, you can deposit money to your savings account by direct deposit, or by eCheck remote deposit. You can make deposits while sitting on the couch! Of course, you can always send a check through the mail. Take control of your savings without worrying about monthly fees and other hidden charges. Capital One invests in its clients’ financial growth, and the free-fee savings account is a testament to this.

Complete any banking transactions using online tools. You can pay your bills, transfer money, and complete a deposit with your mobile app. Easily deposit a habit of saving the easy way with the 360 Performance Savings. Set up an Automatic Savings Plan, and decide how much you want to allocate to your savings account and how often. From then, you can sit back and watch your money grow with you. Or you can choose to withdraw funds, online at any branch. But just like the other banks featured in this article, you cannot make ATM withdrawals.

Be secured with Capital One’s 360 Performance Savings accounts as it is insured by the FDIC. Take note of the 6 allowable monthly transactions imposed by the Reg D.

| PROS | CONS |

| $0 minimum opening deposit | No access to ATMs |

| Fee-free banking | Does not allow cash deposits |

| Free online banking tools | |

| Competitive high-yield interest rate | |

| No balance caps | |

| Online and mobile banking access | |

| eCheck Deposit Feature |

Our Verdict

Ease of Enrollment

Interest Rate

Online Features

Account Maintenance

Customer Support

OVERALL

Discover Bank

Watch:

Error! You must specify a value for the Video ID, Width, Height parameters to use this shortcode!

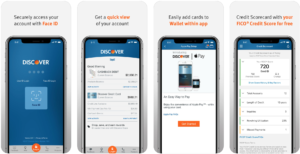

Discover is focused on becoming the leading direct bank in the country, as well as payments services company providing secure transactions in every turn. By helping every American become better spenders, Discover believes that many will manage debt better, save more and realize quality financial future. From the first ever purchase made with a Discover credit card in September 17, 1985 up to today, it continues to make impressive innovations in the business. This vision navigates the company to achieve what DISCOVER stands for – Doing the right thing, Innovation, Simplicity, Collaboration, Openness, Volunteerism, Enthusiasm, and Respect.

At Discover, you get the best services that your traditional brick-and-mortar bank, as well as an online-only bank, can provide. Whether you are looking for banking or credit products, you are in good hands with Discover Bank. It is an FDIC-insured banking institution with numerous options. Aside from the Discover Credit Cards that have become a part of every American household, the Online Savings Account is the bank’s primary service.

Key Features

Discover Bank’s Online Savings Account will let you turn your savings into something that you can be proud of. You will get 5x higher than the national average APY when you choose to save your money at Discover. At 1.80 percent APY, your $15,000.00 savings will gain $269.00 in a year or $1,396.00 over five years. In some banks, clients will only earn as little as $8.00 annual interest. But whether you choose other online savings banks from this list, you will gain significant interest. It is because we sifted through almost every online banks out there, and came up with Ally, CIT, TAB, Capital One, and Discover. These banks offer some of the highest APY in their online savings account. You can open an account even with no minimum deposit and without thinking of paying any monthly fees and other dues.

Watch:

Error! You must specify a value for the Video ID, Width, Height parameters to use this shortcode!

Because you are always on the go, you need a bank that matches with your needs. With the Discover mobile app, your Online Savings Account can be with you at all times. Check your savings account with a few taps on your smartphone. You can even skip entering your passcode when you enable touch or face ID login.

You can make remote check deposits by snapping a photo of the check with your smartphone or tablet. Transferring money from your Discover Online Savings Account to another is easy. Instantly receive internal bank transfers, while inter-bank transfers only take about 4-5 days. Basic is the rule in banking that certain withdrawals are subject to the 6 monthly transactions limit. However, you can make unlimited check deposits when official checks are sent through the mail.

Whenever you are ready to start saving, choose Discover Bank Online Savings Account. Friendly customer support is always available to help you get started. Once your online enrollment is approved, you will get to enjoy the perks of modern-day banking.

| PROS | CONS |

| $0 minimum opening deposit | No access to ATMs |

| Fee-free banking | No cash deposit |

| Free online banking tools | |

| No insufficient funds or overdraft fees | |

| No monthly maintenance | |

| Expedited delivery for official bank checks | |

| Online and mobile banking access | |

| eCheck Deposit Feature |

Our Verdict

Ease of Enrollment

Interest Rate

Online Features

Account Maintenance

Customer Support

OVERALL